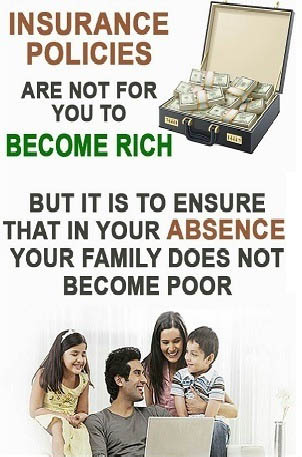

One of the most important things you can do as parents is to ensure the financial welfare of your children in the event of your death. Life insurance is the best way to be rest assured that your children will be taken care of if you die. Although we never like to think of that kind of thing happening, but it does. Under life insurance, the life of the individual is assured. This means that at the time of his/ her death, the family members receive an assured amount. Life insurance not only helps the survivors for their financial requirement after death of the earning member, but also helps in achieving financial goals during the lifetime. It also provides a tool of savings and tax planning.

One of the most important things you can do as parents is to ensure the financial welfare of your children in the event of your death. Life insurance is the best way to be rest assured that your children will be taken care of if you die. Although we never like to think of that kind of thing happening, but it does. Under life insurance, the life of the individual is assured. This means that at the time of his/ her death, the family members receive an assured amount. Life insurance not only helps the survivors for their financial requirement after death of the earning member, but also helps in achieving financial goals during the lifetime. It also provides a tool of savings and tax planning.

What is Life Insurance?

Life insurance is a policy that you can enter with your insurance company, which promises a certain amount to your beneficiary (ies) in the event of your death. Usually, a spouse will name the other spouse as well as their children as beneficiaries of the policy. As part of the agreement with life insurance, your insurance policy will be a monetary value, that you will in return, pay a monthly premium for. Premiums usually depend on your age, gender, occupation, medical history and other factors.

There are other types of life insurance that may provide benefits for you and for your family while you are still living. These policies can accrue a cash value on a tax-deferred basis and can be used for future needs such as retirement or your childs education.

Do I Need Life Insurance?

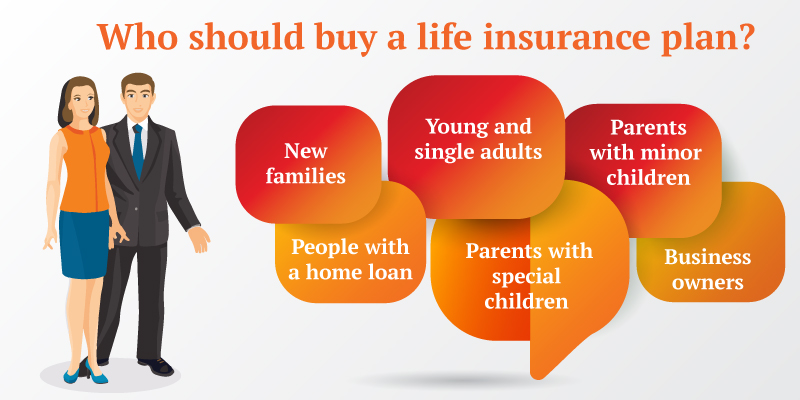

Earning an income allows you and your family to do many things. It pays for your mortgage, buys cars, food, clothing, vacations and many other luxuries that you and your family enjoy. However, certain situations can cause you to lose your income, and those who depend on you also depend on your income. If any of the following statements about you and your family are true, then it is probably a good idea for you to consider life insurance.

1) You are married and have a spouse.

2) You have children who are dependent on you.

3) You have a parent or relative who is aging, or disable and depends on you.

4) You have a loved one in your life that you wish to provide for.

5) Your retirement plan, pension and savings arent enough to insure your loved ones future.

What Are My Life Insurance Options?

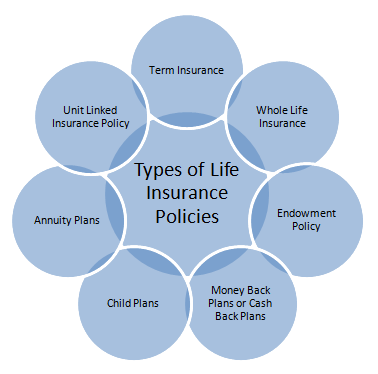

There are four basic types of life insurance that can meet you and your familys needs:

Term Life Insurance

This is the least expensive type of life insurance coverage & simple way of insurance. Term life insurance policies do not accrue cash value, and are fixed over an extended period of time – usually one to 100 years and they can be renewed. In case of Death of Life insured in the pre decided policy term, then insurance company is liable to pay the Sum Assured to Nominee or legal heirs of Insured person. The premiums of term life insurance are lowest when you are young and increase as you get older

Whole Life Insurance

This type of life insurance is similar to term life insurance, as well as provides cash value. Over time, whole life insurance generally builds up a cash value on a tax-deferred basis, and some even pay its policy holders a dividend. This type of life insurance is popular, due to the cash value that is accessible to you or your beneficiaries before you die. Used to supplement retirement funds, or to pay for your childs education, whole life insurance should be used for protection, rather than for accumulation.

Universal Life Insurance

This type of life insurance is a flexible kind of plan. These policies accrue interest and allow the owner to adjust the death benefits and premiums to their current life situation. You decide the amount of premium for universal life insurance, and of you skip a payment, this will be deducted from your death benefit. Universal life insurance stays in effect as long as your cash value can cover the costs of the policy. These rates are subject to change, but they can never fall below the minimum rate that is guaranteed when you sign up for universal life insurance.

Variable Life Insurance

This type of life insurance is designed for people who want to tie the performance of their life insurance policy to that of the financial market. The policy holder gets to decide how the money should be invested, and your cash value has the opportunity to grow more rapidly. However, if the market is poor, your life insurance policys death benefit will be poor. As with whole life insurance and universal life insurance, you may withdraw against the cash value. Be reminded that withdrawals of this life insurance policy will be deducted from the cash value.

Benefits of Investing in Life Insurance

You now know the benefits of investing in life insurance.

The business owner, died unexpectedly. And at a very young age.

But, his business didn’t suffer. Neither his family members faced financial crisis as he had a term plan of a sound sum assured to help his family to maintain their lifestyle.

Now, you may not the same question again, is life insurance is a good investment?

We are one of Premier financial advisors in India, providing a complete range of financial solutions.We offer Investment Advice to High Net Worth as well as Retail Investors. The products being serviced include investment in Fixed Income schemes, Mutual Fund Schemes besides term insurance, health insurance & Equity trading.